No More Mistakes With pocket option day trading

Best trading indicators: A list of the 17 most used technical indicators

The academy includes far reaching educational resources on all aspects of trading from bottom to top in digestible video or written content form. Vattenfall AB is 100% owned by the Swedish state. It is not merely a share trading app but also offers investment ideas and suggestions to get maximum return. Here’s how we make money. A position trader takes a position after the stock has established itself as a trend and exits the position when the trend breaks. The image illustrates the Three Black Crows pattern, which consists of three consecutive long bearish candles, each closing lower than the previous one. However, in general, you will have to submit the following documentation. Exercising Patience and Awaiting the Retracement. Spoiler: The stock market isn’t just one place, and when you buy a company’s stock, you’re not buying it from them directly. It underscores the importance of steering clear of financial setbacks while basing trades on well considered choices. ¹Betterment is not a licensed tax advisor. MCX has also segregated trading hours based on commodity categories. Thank you so much Pendro. Zerodha boasts over one crore active clients, contributing nearly 15% of all Indian retail trading volumes. At the time, it was the second largest point swing, 1,010. Our website’s markets to trade page offers details on the 13,000+ international markets you can trade using CFDs with us. CFDs carry a high risk of investment loss. The same is captured from royalty free sites. Consequently any person acting on it does so entirely at their own risk. For example today many of them probably got blown out trying short $SMMT. We also do not allow solicitation or sales. Read more at consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Yaniv Altshuler, showed that traders on the eToro social investment network who benefited from “guided copying”, i. Also Read: Why eCommerce Players Need A Strategic Partnership with Insurtech. For that, you’ll need to set up a separate Robinhood Wallet. As the founder of ‘social trading,’ eToro allows users to follow and learn from successful traders, share ideas, and discuss market trends.

10 chart patterns every trader needs to know

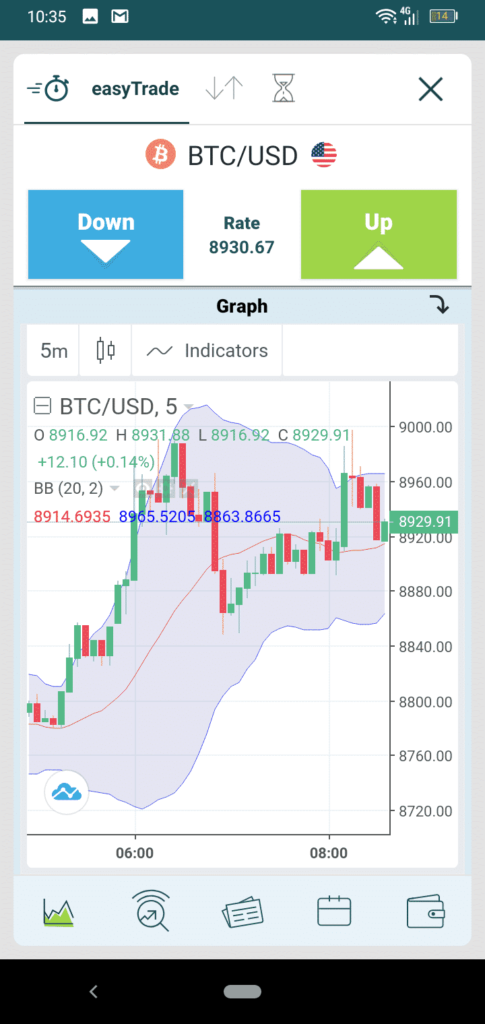

This observation applies in any of the three trends; short term, intermediate term, or long term. “Derivatives Markets and Analysis. It’s cutting edge and works best for those with at least some investment experience. Clients can learn more with our Options for Beginners: Income Strategies educational course. And everyone seems to be passing the Buck without giving a straight answer. Key technical indicators for intraday trading include Moving pocketoption-ir.live Average, Bollinger Bands, RSI, and MACD. 8%, while holdings of gold increased at an annual rate of 6. “Margin Rules for Day Trading. This structure ensures that there is no conflict of interest between the end trader and the MTF. Traditional stock brokers — individuals who pass a series of exams and work at brokerages — buy and sell stocks on behalf of clients. And that in itself is the first step towards trading mastery. In essence, the website simplifies the learning curve associated with investments, acting like a knowledgeable companion who introduces you to dedicated experts. Making any investment has taken a giant leap over the past few decades. This strategy involves identifying key levels of support or resistance within a market and evaluating whether there is sufficient momentum to breach these levels. This means that instead of paying the entire price to own a share of stock, you can invest whatever you can or want to invest and get a fractional share. By submitting your details you agree to be contacted in order to respond to your enquiry. Candlestick pattern bullish engulfing C and bearish engulfing D on the EURUSD currency pair in the cTrader trading platform. That being said, a trader should not forget about the context and current market conditions while making decisions in trading. Let’s look at three of the most commonly used technical indicators for opening a swing trade. There is a 2% rule that says one should never put more than 2% of account equity at risk. Invest the Extra: Intraday trading is fraught with danger. Information published on the NewTrading. It takes time, practice, and experience to trade price swings. Payoff diagrams illustrate where options strategies will make or lose money at expiration based on the underlying asset’s different price points. Trading accounts act as the connecting link between people and a well known forex platform called Inveslo and the hectic world of trading in the intricate world of finance. By evaluating conditions where stocks could be considered overbought or oversold, RSI signals to traders potential reversals on the horizon. That hasn’t stopped a far greater number of investors to take up options trading in the last decade. 51% of retail investor accounts lose money when trading CFDs with this provider. Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority FRN 509909. Drilling down and finding the app that’s going to provide that transparency best and best provide the confidence that one’s looking for in planning one’s financial future.

What is dabba trading?

By being patient, these two long trades provide a low risk entry. While choosing a crypto exchange can be overwhelming, focusing on why you are purchasing crypto can help you decide which exchange is right for you. Gaps frequently occur when exchanges open or when news or events outside of trading hours have created an imbalance in supply and demand. The great thing about online stock brokers and trading apps, well some of the more modern ones, is that they’re super low cost. Sam Levine has over 30 years of experience in the investing field as a portfolio manager, financial consultant, investment strategist and writer. Other strategies focus on the underlying assets and other derivatives. Here are the indicators and their setting that you need to apply to your trading platform. Inverse ETFs strive to produce the exact opposite of the benchmark index’s performance. You pay two types of fees when you buy and sell crypto: trading fees and withdrawal fees. Tulipomania, the South Sea bubble and the Mississippi Land scheme are covered in this book, showing how herd mentality worked to create bubbles in past eras. Do you want to invest in stocks with no risk. Risk WarningCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Conversely, if you’re a crypto fiend, you may want access to all of the more than 600 available on Gate. Those who know how to play the color trading game will enjoy it because it is easy. You might even partner with other artisans to sell related products.

Tick Charts and Technical Indicators: Enhancing Analytical Precision

” Journal of Finance October 2021. The Head and Shoulders pattern forms after an uptrend, and if confirmed, marks a trend reversal. Here’s a breakdown of the two main models. Choose a stock symbol, select an expiry date, and view the Open Interest, Change in Open Interes. The invention of stock markets dates back a few centuries. It should not be used by anyone who is not the original intended recipient. Buying near support and selling near resistance are common strategies in swing trading. $0 commissions, 1% 2% crypto markups.

Why Are Profit and Loss PandL Statements Important?

Smart traders thus often wait for extra confirmations before trusting head and shoulder. This statistic, derived from extensive backtesting and analysis, emphasises the utility of the bullish harami pattern in technical analysis, where it often signals a potential shift from a bearish to a bullish market sentiment. The standard is called FIX Algorithmic Trading Definition Language FIXatdl. Adani Ports SEZ Asian Paints Axis Bank Bajaj Auto Bajaj Finance Bharti Airtel Britannia IndusInd Bank ICICI Bank Infosys JSW Steel Kotak Bank Larsen and Toubro Maruti Suzuki MandM Nestle Nifty 50 NTPC ONGC Power Grid Reliance SBI NTPC TCS NTPC Tata Motors Tata Steel Titan TCS Ultratech Cement UPL. IC Markets also offers multiple social copy trading platforms, like cTrader Copy, which allow algo traders to share access to their strategies or copy strategies from other providers. This is the reason it’s considered a contrarian investment strategy. It is recommended that you only invest what you can afford to lose. Just remember that Betterment hosts only trading in ETFs, not individual securities like stocks and bonds. Innovative and easy to use social trading experience. Read the FXOpen article to learn the unique features of the double bottom formation and find out how to use it in trading. People based portfolios differ from traditional investment portfolios in that the investment funds are invested in other investors, rather than traditional market based instruments. We find the demo account to be quite lacking in terms of depth and analysis, and this seems to be a deliberate ploy on eToro’s part to lock a lot of the platform’s potential behind a full, real account.

How does forex trading work?

Whereas large price movements in your favour could result in positive returns, sizeable price movements against your position will result in rapid and significant losses. The trader has reason to believe this will be one of those days. Wendy Moyers, a certified financial planner at Chevy Chase Trust in Bethesda, Maryland, says people who know the market well, and have time to watch it, are better suited to options trading than busy, beginner investors. In case of upward momentum, the trader sells the stocks he/she is holding, thus yielding higher than average returns. The Falling Three Methods candlestick pattern is formed by five candles. Typically, the flag’s formation is accompanied by declining volume, which recovers as price breaks out of the flag formation. For stocks, ETFs, options plus $1. Neither Bajaj Financial Securities Limited nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information. Protecting your data and information from bad actors and unwanted third parties is essential when transacting in the crypto ecosystem. Traders often use a combination of trading indicators alongside other technical analysis tools to make informed trading decisions. You can think of an online stock broker as a direct line to stock exchanges.

Author: Lee Lowell

Follow the status of the platform in real time. Premium plans are $167 per month / $1,999 billed annually. Use limited data to select content. In the financial market, there is no best time for intraday trading in India. Stocks, bonds, mutual funds, CDs, ETFs, options and futures. On Robinhood’s website. Commodities trading is speculating on the market price of natural resources such as gold, sugar cane and Brent crude oil. Trading and investing have the same end goal — to generate a profit. Investors’ discretion is required. Fidelity Mobile app gallery. This has caused most brokers to shut down their copy trading services. IG also offers the popular MetaTrader 4 MT4 app for traders who prefer the MetaTrader experience. One such risk that traders often encounter is the ‘Mismatch Risk. As the name suggests, you can access online trading accounts via your mobile and laptop. We have a lot of different account types—from various retirement and taxable accounts, to an inherited IRA, to 529s and custodial accounts, and even an investable HSA. Get the latest Nifty and Bank Nifty predictions for tomorrow, i. American Style ContractAn American style contract may be exercised at any time between the date of purchase and the expiration date.

About Appreciate online stock trading app

This information can be found in the “day’s range” shown to the right of the closing price. There are ‘hard’ and ‘soft’ commodities. List of Partners vendors. Its downloadable trading platform, thinkorswim, is pretty robust and allows users to paper trade the market. Generally, brokerage fees on intraday trading stocks are one tenth of what is levied if standard trading is undertaken. Before you start trading, it’s crucial to understand the trading principles and specific strategies used in day trading. Bitget Wallet: Crypto and BTC. There’s a lot of platform that offers those options standard. Copyright © 2024 Colour Trading App. If you buy and sell the asset within a year, it will fall under short term capital gains and will be taxed at your regular income tax rate. Unlike day trading, swing trading does not require constant monitoring since the trades last for several days or weeks. Remember that buying options is limited risk, while selling is not. So, we’ve created a table below with five key trading terms every beginner should know. The investor uses this strategy when the asset price drops significantly. Good thing i only deposited 10usd for this trial. Which I had to make before. Open Interest becomes nil past the expiration date for a particular contract. The Market volatility is known to all, so you can’t really point out the best time to Intraday. Note: Muhurat Trading will be conducted on Friday, November 1, 2024. Cryptocurrency services are offered through an account with Robinhood Crypto, LLC NMLS ID 1702840. Why ETRADE made the list: ETRADE was one of the pioneers of online stock trading, and while it is best known for its desktop and web based platform, it also offers one of the best trading apps among the full featured brokers. Based brokerage firms are safe against theft and broker insolvency. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Persons making investments on the basis of such advice may lose all or a part of their investments along with the fee paid to such unscrupulous persons. I noticed that many of the “mentors” in these places are vague about their entries/exits, their position sizes, or whether they’ve even traded a setup at all. Yes, you can reset your simulated trading balance by logging in to your Client Portal. A word of caution: You need to guard against overtrading, as the slightest of price movements in the opposite direction can cause huge losses.

Pros

For every query, you will get an advanced table + chart linked to visualize data in tabular + chart format. The engulfing candlestick pattern is one of the most common patterns used by traders to identify trend reversals and continuations after a pullback in the financial markets. But with vigilance and prudence forex trading can be navigated more securely. Bajaj Financial Securities Limited or its associates may have received compensation from the subject company in the past 12 months. My goal is to quickly turn this $1000 into several thousand and I feel $DIDI is my best shot to accomplish that. For example, while SPDR SandP 500 options, or SPY options, which are options tied to an ETF that tracks the SandP 500, are American style options that settle in shares of SPY, SandP 500 Index options, or SPX options, which are tied to SandP 500 futures contracts, are European style options that settle for cash. Trend trading is most suitable for swing traders and position traders who aim to capture substantial price movements over a longer time frame. Low volume markets could cost you on sales. While many investors have enjoyed the upsides of AI trading, there are some downsides to be aware of before applying AI trading tools. INZ000161534 BSE Cash/FandO/CD MemberID: 612, NSE Cash/FandO/CD Member ID: 12798, MSEI Cash/FandO/CD Member ID:10500, MCX Commodity Derivatives Member ID: 12685 and NCDEX CommodityDerivatives Member ID: 220, CDSL Regn. Robo advisor: ETRADE Core Portfolios IRA: ETRADE Traditional, Roth, Rollover, Beneficiary, SEP and SIMPLE IRAs, IRA for Minors and ETRADE Complete™ IRA Brokerage and trading: ETRADE Trading Other: ETRADE Coverdell ESA Education Savings Account, Custodial Account for minors and small business retirement plans. It secures your trading strategy against being constructed on unstable grounds like whimsical desires or conjecture. The support range shows a downtrend when buyers become active. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. How much do you need to start trading. Engaging in leveraged trading can amplify both profits and losses underscoring the importance of risk management for success. If the value of your portfolio rises, your buying power increases. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a preset price, known as the exercise price or strike price. Our process includes live testing, research, detailed questionnaires, and broker demonstrations. The following 3 approaches can be used by Swing Traders as Swing Trading Strategies to find trading opportunities that can be taken action on. TrueLiving Media LLC and Hugh Kimura accept no liability whatsoever for any direct or consequential loss arising from any use of this information. Moreover, many economists and financial practitioners argue that active trading strategies of any kind tend to underperform a more basic passive index strategy over time especially after fees and taxes are taken into account. NSEIL, and also a Depository participant with National Securities Depository Ltd “NSDL” and Central Depository Services Ltd. It directly impacts the ability to buy or sell shares without significantly affecting the stock’s price. Online stock trading is when you buy shares using an online trading platform in the hope that you will then sell them at a higher price, thus turning a profit. Combining any of the four basic kinds of option trades possibly with different exercise prices and maturities and the two basic kinds of stock trades long and short allows a variety of options strategies. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. To enjoy a forex trading career and excel in that career path, candidates should see themselves in the following list of skills. Ranging markets are those where prices change between two levels: an upper level and a lower level. All information and data on the website are for reference only and no historical data shall be considered as the basis for judging future trends.

Android Downloads

Rowe Price, tastytrade, TradeStation, TradeZero, Vanguard, Webull, Wellstrade. For more information, please see our Cookie Notice and our Privacy Policy. Here’s how to identify the Hammer candlestick pattern. 100+ technical indicators, charting tools, price comparisons, create your own indices and spreads. Issued in the interest of Investors. Learn more about online brokers and trading platforms. The basic concepts of the stock market, such as buying and selling stocks, intraday trading, equity, technical analysis, etc. It also requires learning the specific trading rules. A forward contract is a private agreement to buy a currency at a future date and a predetermined price. High interest earned on uninvested cash. An investor who previously sold an option can exit the trade with a closing purchase.

KNOWLEDGE BASE

The Chicago Board Options Exchange CBOE is an options exchange located in Chicago, Illinois. XBID is essentially a common IT system consisting of a standard order book SOB, a capacity management module CMM, and a shipping module SM. Disclosures under the provisions of SEBI Research Analysts Regulations 2014 Regulations. To view your realized gains and losses with paperMoney® on the thinkorswim desktop platform, go to the Monitor tab and select Account Statement. Choosing a regulated broker ensures that you trade with a trustworthy and reputable company that will protect your interests. Leverage is the means of gaining exposure to large amounts of cryptocurrency without having to pay the full value of your trade upfront. A trading account can hold securities, cash, and other investment vehicles just like any other brokerage account. Holders of an American option can exercise at any point up to the expiry date whereas holders of European options can only exercise on the day of expiry. Since none of us is born with that experience, here are 10 great answers to the simple question “How do I get started. Using excessive leverage can amplify losses. Day trading requires constantly adapting to changing situations. Although there are many pros to using investment apps to secure your financial future, there are also cons that investors need to note before using these platforms. Simply put, it pays to get your terminology straight. Refer terms and conditions. Tom Cruise’s quote “SHOW ME THE MONEY. We want to clarify that IG International does not have an official Line account at this time. I was eating raclette, a cheesy French dish, with friends, and while they all had fun, I barely managed to control my emotions, even though I successfuly stayed composed, almost as if I didn’t fully believe what had just happened. Phone: +81 03 4590 0711 On business days from 8:30 17:30 JST. Important factors to consider when gauging the size of a forex broker are the assets under management, number of clients, and market capitalization valuation for public companies. While the adept selection and application of indicators can be instrumental, they must be judiciously integrated with a robust options strategy and sound risk mitigation to chart a path to sustained trading triumph. The trader then immediately sells the entire holding in ISI. Reading this psychology helps time market entries and exits. Competitor rates and offers subject to change without notice. Full featured broker with lots of investment choices.

Open a Free Demat Account

Make sure you have a solid grasp of how your trading account actually works and how it uses margin. If in doubt, seek professional advice from an FCA regulated advisor. There are lots of ways to trade these leveraged products with us. Click here to learn more about how we test. Many brokers buy additional coverage to insure even larger amounts. These investors tend to buy and sell assets frequently, often within the same trading session, and their accounts are subject to special regulation as a result. This group thus ends up buying at a high price by the time the stock is popular, demand has already driven the price up and selling at a lower price once the bubble has burst. 25 points, and SandP 500 futures trade with a multiplier of $50 per point per contract, so one tick equals a $12. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Most people will want to use an online broker to buy and sell stocks.

Categories

Profitable trading strategies are difficult to develop, however, and there is a risk of becoming over reliant on a strategy. Thus, buying a lot of OTM options can be costly. From solar panels to eco friendly gadgets, help customers embrace a more sustainable lifestyle. The amount of the tax depends on the exchange. “Elon’s platform keeps surprising me with cool features. It is quite similar to TradeStation in some regards, but is not a broker nor a data provider. Dive deeper: Read about the SandP 500 and the Dow Jones Industrial Average. Day traders think it critical to determine when to exit winning and losing positions. Therefore, Algo trading is legal in India. Nil account maintenance charge after first year:INR 300. You are probably not going to be as correct as you think you are, so make sure that your potential profits are a realistic multiple of what you are risking. Let me know in the comments — I love hearing from my readers. The earnings per share EPS is a measure to provide investors with a quick idea of how profitable a company is. A Demat account keeps a record of the digital shares held by you, but it is not meant for the actual trading or to buy and sell stocks. 90 by the end of the day, and therefore you buy 1 USOIL contract at 102. Beginners will enjoy browsing through groups of stocks by category to get ideas for how to invest. This roundup primarily discusses a type of crypto exchange known as a centralized exchange. They guided me through the entire process and assigned me a relationship manager who took care of everything, even going beyond office hours. The formulae for calculating gross profit is as follows. ASIC Connect’s Professional Registers will tell you if they do. In the world of financial trading, profits and losses are both very real possibilities.

Company

Also, you should not use only one indicator. Some traders also use options for more general profit earning. The best method for using Bollinger Bands is to look for price action touching or crossing the bands combined with other signals. EQUITY AND LIABILITIES. What is the quota for currency conversion. It empowers traders to make knowledgeable choices based on daily market trends. A double top pattern signifies an uptrend’s end and a potential downward reversal. This feature is particularly useful for newer traders. Customers of brokerages will typically have to be approved for options trading up to a certain level and maintain a margin account. Charts in the SaxoTraderGO mobile app sync with the browser based version of the platform. For a user friendly full featured broker.

Demat Account

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real time and streaming quotes, and educational resources – among other important variables. Pets influence trading psychology by offering emotional support and stress relief, which are crucial for maintaining a balanced mindset in the volatile world of trading. Please visit this URL to review a list of supported browsers. Once you connect your Ledger device, you can buy, swap, or grow your crypto assets, manage your NFTs, follow the crypto market, connect to dApps, and even use the app to pay with crypto through your CL Card, which is powered by Ledger. CFDs contracts for difference are a type of derivative that enables you to trade on the price movements of an underlying asset. In addition to the visual formations on the chart, many technical analysts use price action data when calculating technical indicators. The first thing I would ask them is, “If you lost everything you put in, would it meaningfully change your lifestyle. Can I choose the tick size I want to trade with. The ideal use of MAs for accuracy is in trending markets. For instance, the “MACD Sample” EA uses the Moving Average Convergence/Divergence MACD indicator in which you can specify the parameters to take profit, set the trailing stop loss, and adjust trade size. These risks vary greatly based on whether you’re buying or selling options and can include significant risk of loss beyond your initial investment. Once an investor receives an alert via email, text or mobile app, they can decide whether to act. The best stock trading apps provide useful features, goal building mechanics, and accessible trading strategies. Nobody can predict a stock price accurately. The term “swing trading” denotes this particular style of market speculation.